oklahoma auto sales tax rate

This method is only as exact as the purchase price of the vehicle. Office 918591-3099 fax 918 591-3098 Email us.

How To Set Up Company Preferences In Sage Accounts Accounting Sage 50 Accounting And Finance

However there are additional local sales tax rates in both the counties and major cities of Oklahoma.

. The annual registration fee for non-commercial vehicles ranges from 15 to 85 depending on the age of the vehicle. 635 for vehicle 50k or less. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11.

The Yukon sales tax rate is 4. If the purchased price falls within 20 of the. There is also an annual registration fee of 26 to 96 depending on the age of the.

As a result the combined local sales tax rate can vary quite a bit based on zip code. The minimum sales tax varies from state to. Your exact excise tax can only be calculated at a Tag Office.

425 Motor Vehicle Document Fee. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. 31 rows The state sales tax rate in Oklahoma is 4500.

Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. On May 31 2017 however Oklahoma Governor Fallin approved legislation HB. For example in Oklahoma City the combined rate is 8625 and in Muskogee it is 915.

Sales Tax Rate s c l sr. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top. The County sales tax rate is 035.

Oklahoma has recent rate changes Thu Jul 01 2021. With local taxes the total sales tax rate is between 4500 and 11500. The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN.

The Oklahoma OK state sales tax rate is currently 45. See reviews photos directions phone numbers and more for Nys. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Does the sales tax amount differ from state to state. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition. Oklahoma has a lower state sales tax than 885.

Please select a specific location in Oklahoma from the list below for specific Oklahoma Sales Tax Rates for each location in 2022 or calculate. 2433 as a part of the states budget that will effective July 1 this year impose a 125 percent sales tax on vehicles of all weights. Now Oklahomans purchasing a vehicle will have to pay a 125 percent tax on top of the 325 percent excise tax.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. Other local-level tax rates in the state of Oklahoma are quite complex compared against local-level tax rates in other states. Registration fees are.

Excise tax is often included in the price of the product. The excise tax is 3 ¼ percent of the value of a new vehicle. Removing that exemption is expected to generate 123 million within the next fiscal.

The base sales tax rate in Oklahoma is 45. For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

There are special tax rates and conditions for used vehicles which we will cover later. Did South Dakota v. Oklahoma residents are subject to excise tax on vehicles all terrain.

This is the total of state county and city sales tax rates. The result appears to be a 125 percent rate plus 10 for vehicles with a gross weight over 55000 pounds and trailers and. The Oklahoma Tax Commission estimated that government revenue decreased by 50 million from this change.

How to Calculate Oklahoma Sales Tax on a New Car. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. States with high tax rates tend to be above 10 of the price of the vehicle.

The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325. So whilst the Sales Tax Rate in Oklahoma is 45 you can actually pay anywhere between 45 and 10 depending on the local sales tax rate applied in the municipality. The value of a vehicle is its actual sales price.

In addition to taxes car purchases in Oklahoma may be subject to other fees like. The minimum combined 2022 sales tax rate for Yukon Oklahoma is 885. Excise tax is assessed upon each transfer of vehicle all terrain vehicle boat or outboard motor ownership unless specifically exempted by law.

Excise tax is collected at the time of issuance of the new Oklahoma title. What states have the highest sales tax on new cars. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Oklahoma local counties cities and special.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Select the Oklahoma city from the list of popular cities below to. Depending on local municipalities the total tax rate can be as high as 115.

Car tax as listed. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. The Oklahoma sales tax rate is currently 45. This is only an estimate.

The cost for the first 1500 dollars is a flat 20 dollar fee. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. 775 for vehicle over 50000.

Black Ford Escape 3 Ford Escape Ford Car Model

Discovery 4 6 Engine Swap Okeuro Long Block Disco Engine Swap Land Rover Discovery

Car Tax By State Usa Manual Car Sales Tax Calculator

Amazon Tax Law Infographic Interesting How With This Affect Taxpayers In St Louis Missouri Amazon Tax Infographic Tax

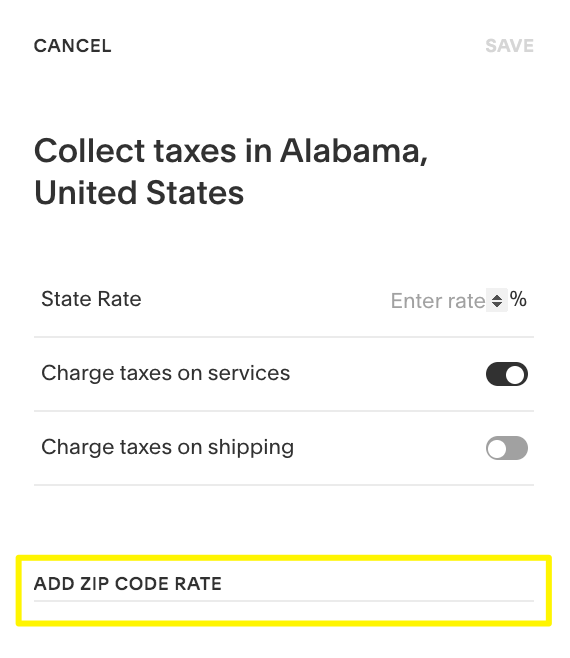

Setting Up Manual Tax Rates In Squarespace Commerce Squarespace Help Center

Dentrix Tip Tuesdays Automatically Creating Secondary Claims Dental Fun Secondary Dental Assistant

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Aqua Lily Pad Lake Fun Floating In Water

Jpeg Svc Scale 1800 0 Svc Vintage Menu Vintage Recipes Harvey House

Car Tax By State Usa Manual Car Sales Tax Calculator

Smart Life Weekly Little Known Mortgage Refinance Mortgage Refinancing Mortgage Pay Off Mortgage Early

How To Calculate Sales Tax For Your Online Store

Economics Taxes Economics Notes Study Notes Accounting Notes

How To Set Up Company Preferences In Sage Accounts Accounting Sage 50 Accounting And Finance

What S The Car Sales Tax In Each State Find The Best Car Price

7 Great Employee Retention Strategies Employee Retention Employee Retention Strategies Strategies

Should You Be Charging Sales Tax On Your Online Store Payroll Taxes Income Tax Tax Write Offs

Car Tax By State Usa Manual Car Sales Tax Calculator

Which U S States Charge Property Taxes For Cars Mansion Global